prince william county real estate tax relief

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Ad You Dont Have to Face the IRS Alone.

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

End Your Tax Nightmare Now.

. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. It is true that CuraDebt offers a program for tax relief that will help you with problems such as late payroll taxes and garnishments on wages. We Help Taxpayers Get Relief From IRS Back Taxes.

The Duchy of Cornwall is a private estate established in 1337 by Edward III to provide independence to his son and heir Prince Edward. Ad 5 Best Tax Relief Companies of 2022. Monday - Friday 830 am - 430 pm.

Hi the county assesses a land value and an improvements value to get a total value. End Your Tax Nightmare Now. Then they get the assessed value by multiplying the.

All you need is your tax account number and your checkbook or credit card. About the Company Prince William County Property Tax Relief For Seniors CuraDebt is an organization that deals with debt relief in Hollywood Florida. Prince William Countys personal property tax rate of 370 per.

Prince William County Virginia Home. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county. In 1969 Charles was 21 when he.

A convenience fee is added to payments by credit or debit card. Clients are usually charged a percentage computed on any tax. 609 567-0700 option 3.

Whats the first thing I have to do after joining the. The board took the. Ad 5 Best Tax Relief Companies of 2022.

Ad Based On Circumstances You May Already Qualify For Tax Relief. It was founded in 2000 and is a. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

How property tax calculated in pwc. The Finance Department of Prince William County administers a real estate tax relief program for older adults age 65 and older as well as adults with total and permanent disability who meet. Ad Based On Circumstances You May Already Qualify For Tax Relief.

Other public information available at the real estate assessments office includes sale prices and dates legal descriptions descriptions of the land and buildings and ownership information. Payment by e-check is a free service. In Virginia personal property tax rates are set by local governing bodies during budget season every spring.

We Help Taxpayers Get Relief From IRS Back Taxes. Which allows municipalities to extend the. Often a resulting tax assessed discrepancy thats 10 or more above the representative median level will be checked out.

Get the Help You Need from Top Tax Relief Companies. July 15 -- until Oct.

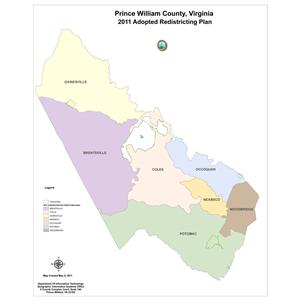

The Rural Area In Prince William County

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William Class Sizes Are Highest In Virginia Washington Region The Washington Post

In The Rural Crescent Debate Some See Conservation Others See Exclusion News Princewilliamtimes Com

Prince William County Real Estate Taxes Due July 15 2022 Prince William Living

Prince William County Virginia 1805 1955 Businesses

Job Opportunities Prince William County

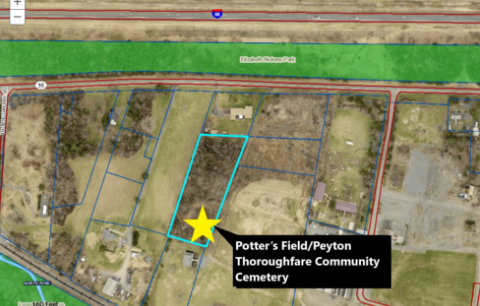

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

Prince William Supervisors Finalize Fiscal 2023 Spending Plan Headlines Insidenova Com

Prince William Board Of County Supervisors Commends George Mason University On Its 50th Anniversary

Rural Crescent In Prince William County

Less Taxes Less Spending Prince William Residents Decry Proposed Hike In Tax Bills Headlines Insidenova Com

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Prince William Board Of County Supervisors Adopts Fy2023 Budget Prince William Living

Bland Family Of Stafford Prince William Loudoun Co S Va And Edgefield County Sc Goyen Family Tree

Less Taxes Less Spending Prince William Residents Decry Proposed Hike In Tax Bills Headlines Insidenova Com