nebraska sales tax rate on vehicles

Beginning October 1 2014 the sales and use tax imposed on the sale of all-terrain vehicles ATVs and utility-type vehicles UTVs is collected by the county treasurer or other designated county official at the time the purchaser makes application for the certificate of title. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts.

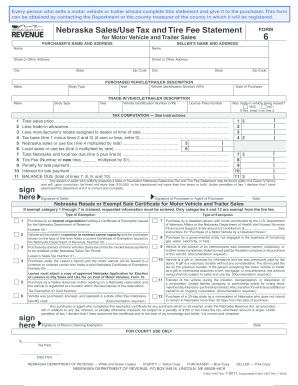

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow

LB 814 2014 Letter to County Treasurers Letter to Dealers.

. Money from this sales tax goes towards a whole host of state-funded projects and programs. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825.

21600 for a 20000 purchase Beatrice NE. 150 - State Recreation Road Fund - this fee. 800-742-7474 NE and IA.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. FilePay Your Return.

If the state the vehicle was purchased in has reciprocity with Nebraska the total sales tax paid in that state will be credited toward the total state and local use tax due in Nebraska. Waste Reduction and Recycling Fee. Thus if the rental of a vehicle is 100 for a day the business would tax the renter a total of 1125 percent as long as the county rental fee is listed separately.

Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0825 for a total of 6325. 55 Average Sales Tax With Local. Sales and Use Taxes.

This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. 6325 Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. Subsequent brackets increase the tax 10 to 40 for each 2000 of value when new or two percent.

This is less than 1 of the value of the motor vehicle. 1 day agoThe 24 tax would be about 102 million each year and additional federal taxes of about 55 million bringing the subtotal to about 269 millionAfter Nebraskas state taxes according to the. With local taxes the total sales tax rate is between 5500 and 8000.

Sales Tax Rate Finder. Here are five additional taxes and fees that go along with a vehicle purchase. NE Sales Tax Calculator.

This applies to the total value of the vehicle not just the down payment amount and is required at signing instead of being able to be paid off over time. The statewide sales tax for Nebraska is 55 for any new or used car purchases. While some counties forgo additional costs most will charge a local tax on top of the state rate.

Additional fees collected and their distribution for every motor vehicle registration issued are. Nebraska NE Sales Tax Rates by City Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500. Do Nebraska vehicle taxes apply to trade-ins and rebates.

Nebraska has recent rate changes Thu Jul 01 2021. For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in Nebraska. The Nebraska sales tax on cars is 5.

The state of NE like most other states has a sales tax on car purchases. With a sales tax rate of 55 in Nebraska this means you are paying an additional amount equal to 55 of the vehicles value at the point of sale. Annual Sales Tax Summary 1967-2021 This table shows an annual summary of the state net taxable sales and sales tax for other than motor vehicles motor vehicles a combined state sales total local sales tax and a combined state and local sales tax total.

You can find these fees further down on the page. The average combined sales tax rate for Nebraska is 6324. Click here for a larger sales tax map or here for a sales tax table.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The Nebraska state sales and use tax rate is 55 055. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022.

Nebraska only charges the regular sales tax rate on motor vehicle rentals. General Fund Sales and Use Tax Cash Receipts 1999-current. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services.

Nebraska Sales Tax on Cars. Select the Nebraska city from the list of popular cities below to see its current sales tax rate. However local governments can charge up to 575 percnet of the contract amount as a county rental fee.

Printable PDF Nebraska Sales Tax Datasheet. No refund will be made if the other states tax rate exceeds the total Nebraska and local use tax rate. How are trade-ins taxed.

Nebraska Department of Revenue.

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraska Car Sales Tax Reviews And Estimates Getjerry Com

What S The Car Sales Tax In Each State Find The Best Car Price

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Car Financing Are Taxes And Fees Included Autotrader

What Is The Gas Tax Rate Per Gallon In Your State Itep

Sales Tax On Cars And Vehicles In Nebraska

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Taxes And Spending In Nebraska

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Taxes And Spending In Nebraska

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan