free cash flow yield s&p 500

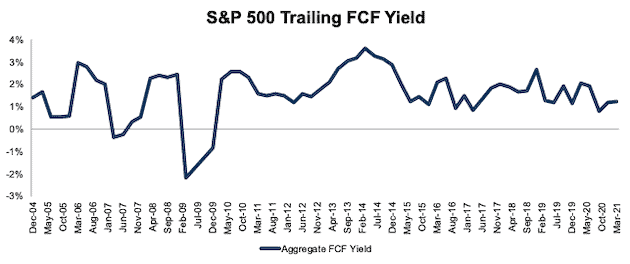

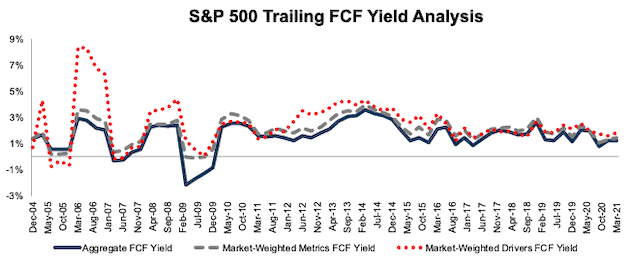

The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500 companies. 2021 was a very profitable year for the SP 500.

Fcf Yield Increased In Six S P 500 Sectors Through 3q21 Seeking Alpha

Dont let this fool you though.

. SP Global Ratings Ratings SP Global Market Intelligence Market Intelligence. Listed Highland Capital Management ETFs. The table below includes fund flow data for all US.

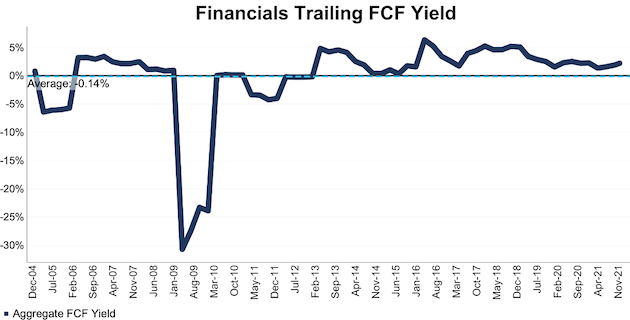

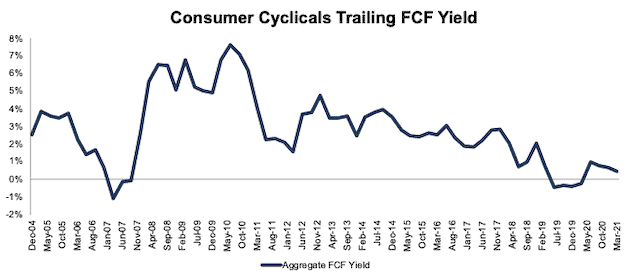

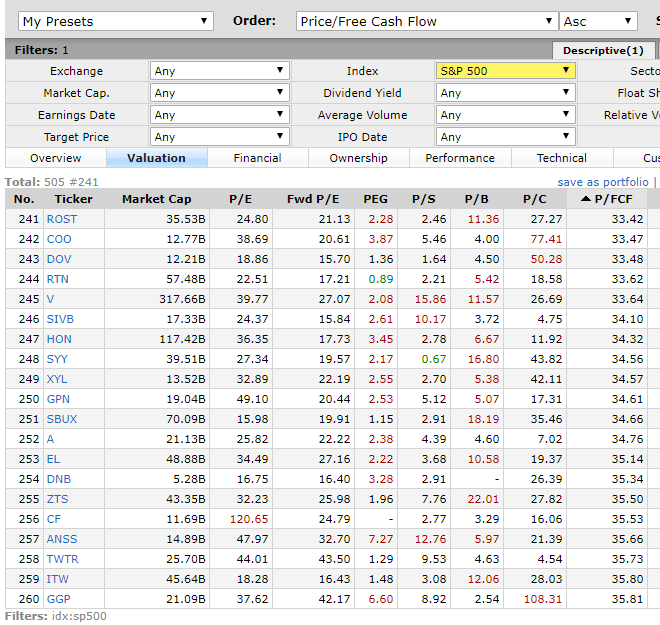

Learn everything about AAM SP 500 High Dividend Value ETF SPDV. Only three SP 500 sectors saw an increase in trailing FCF yield YoY based on 2020 financial data as well show below. Using the equation of Enterprise Value Free Cash Flow stocks with a lower ratio are favored over those with a higher ratio.

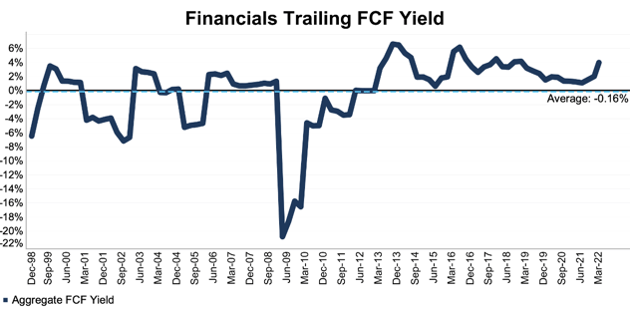

Free cash flow yield is really just the companys free cash flow divided by its market value. The trailing FCF yield for the SP 500 fell from 2 at the end of 2019 to 12 as of 32321 the earliest date 2020 annual data was provided by all SP 500 companies. See the full List.

What Is Free Cash Flow Yield. Transactiegeschiedenis van de index SP 500 DIVIDEND AND FREE CASH FLOW YIELD INDEX TR USA. Challenge the Old Buy and Hold.

As of March 11 the markets free cash flow yield is about 54. Note first quarter Numbers include only companies who have reported first quarter earnings results. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period.

The company operates through four reportable segments. Daily chart SP 500 DIVIDEND AND FREE CASH FLOW YIELD INDEX. Called the free cash flow yield this gives investors another way to assess the value of a company that is comparable to the PE ratio.

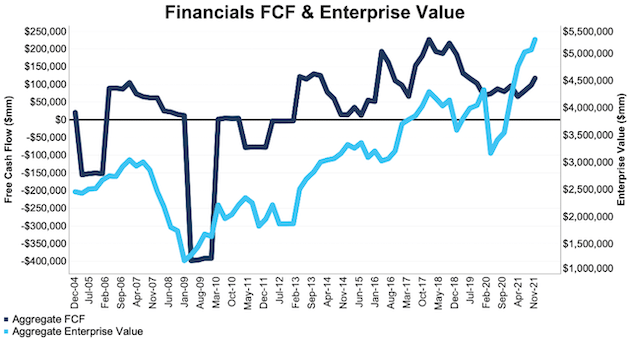

Is a leading provider of transparent and independent ratings benchmarks analytics and data to the capital and commodity markets worldwide. The table below shows the list of 22 SP 500 stocks with Enterprise Value Free Cash Flow less than 10x at present. Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118.

SP 500 realized contraction in Free Cash Flow by -1792 in 1 Q 2022 year on year. 2 months 3 months 6 months. The trailing FCF yield for the SP 500 rose from 11 on 33121 to 22 as of 31122.

The recently launched SP 500 Dividend and Free Cash Flow Yield Index combines dividend yield and free cash flow yield in the constituent selection process. Free cash flow yield. From a value angle these stocks are considered cheap.

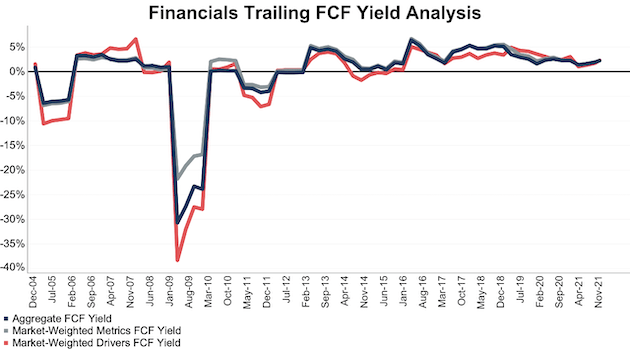

The valuations of the years 2007 through 2011 were the exception not the norm. SP 500 FCF Yield in Q4 Rose above Pre-Pandemic Levels. Only five SP 500 sectors saw an increase in trailing FCF yield from 1Q20 through 1Q21 as well show below.

From 1978 to 2018 the average FCF yield of the SP 500 was 485. Advanced Emissions Solutions ADES Dividend Yield. Numbers change as more businesses report financial results.

SP 500 Dividend and Free Cash Flow Yield Index. The trailing FCF yield for the SP 500 rose from 11 on 33121 to 22 as of 31122. 1 Yr Return 230.

Fox Corp Class A NASDAQ. The trailing FCF yield for the SP 500 rose from 08 in 2Q20 to 19 as of 81821. The index Launch Date is Oct 02 2017.

Its less than its highs but this doesnt mean the markets expensive. SP 500 FCF Yield Rebounds In Q1 2021. The following table presents historical return data for ETFs tracking the SP 500 Dividend and Free Cash Flow Yield Index.

Sequentially Free Cash Flow fell by -7449. Advanced Emissions Solutions NASDAQ is a small-cap stock 201 million market cap that has a very high dividend. The free cash flow yield is the total free cash flow market capitalization.

Ad Direxion Daily SP 500 Bull Bear ETFs. 154 Best Buy BBY 11493 has gotten off to a strong start in 2021 up roughly 15 for the year to date several percentage points more than. All information for an index prior to its Launch Date is hypothetical back-tested not actual performance based on the index methodology in effect on the Launch Date.

Free ratings analyses holdings benchmarks quotes and news. Here are the 12 stocks with the lowest PFCF in the SP 500 today according to Finviz. Prudential Financial Inc NYSE.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital expenditures from all cash flow. Before the pandemic the FCF yield for the SP 500 was 20 on 33120.

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

Equity Valuation From A Bond Perspective 5 Picks With Attractive Fcf Yields Seeking Alpha

All Cap Index Sectors Free Cash Flow Yield Through 3 11 22 Seeking Alpha

Fcf Yield Increased In Six S P 500 Sectors Through 3q21 Seeking Alpha

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

The S P 500 Median Price To Free Cash Flow Ratio Is Now 34 66 Seeking Alpha

All Cap Index Sectors Free Cash Flow Yield Through 3 11 22

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

All Cap Index Sectors Free Cash Flow Yield Through 3 11 22

Dividend Days Epoch Investment Partners Inc

Fcf Yield Increased In Six S P 500 Sectors Through 3q21 Seeking Alpha

Top Sector Etf For 2021 Free Cash Flow Ring Nasdaq Ring Seeking Alpha

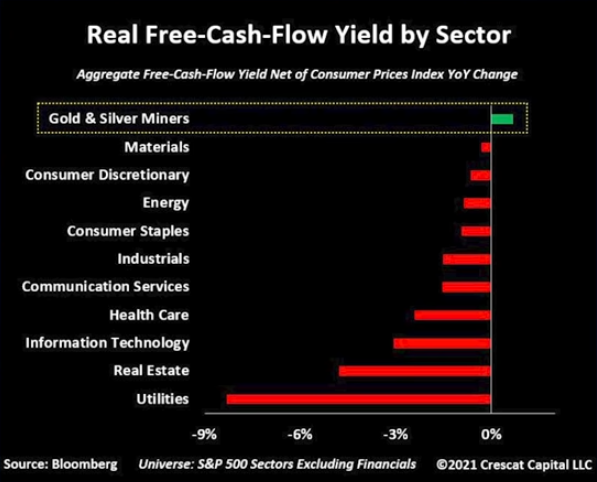

Six Reasons To Own Gold Equities Now

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

The S P 500 Median Price To Free Cash Flow Ratio Is Now 34 66 Seeking Alpha